Exclusive Tips and Tricks

It enables stakeholders to comprehend the entity’s business performance and liquidity status. It likely began with investors who noticed that trends existed within the stock market and saw opportunities to make money by buying and selling at strategic times. RHY is not a member of FINRA, and products are not subject to SIPC protection, but funds held in the Robinhood spending account and Robinhood Cash Card account may be eligible for FDIC pass through insurance review the Robinhood Cash Card Agreement and the Robinhood Spending Account Agreement. Use profiles to select personalised content. 00, for example, would mean that the cryptocurrency has moved a single pip. 25% fee, subject to a minimum fee of US$0. Can I buy a call and a put on the same stock. The option writer seller may not know with certainty whether or not the option will actually be exercised or be allowed to expire. It is important for a trader to remain flexible and adjust techniques to match changing market conditions. It’s neither overly complicated nor so basic that it’s useless to experienced investors. So, without compromising an inch on the quality, security and range of our investment services, we offer incredibly low fees. When I’m trusting my money potentially large amounts to a company I want to know there is someone https://www.pocketoption-br.space/ who’s going to help if there’s a problem. This 1 candle bullish candlestick pattern is a reversal pattern, meaning that it’s used to find bottoms. A stochastic oscillator is another type of momentum indicator, like RSI.

Insufficient capital doesn’t allow business to grow

This indicates a possible trend reversal. Let’s consider more deeply the reasons why companies fail and let it be a warning for those who invest their money in trading. You can learn trading from scratch just by watching it. Explore the immersive world of virtual reality with VR trading. Here’s how to identify the High Wave candlestick pattern. In a short call option strategy, an investor sells call options on something they don’t own. Simple and easy to use interface. Bullish harami candlestick pattern indicates the reversal trend in the stock market, where a small green candle is formed after a continuous downtrend of red candles. Member FINRA/SIPC are separate but affiliated companies and subsidiaries of The Charles Schwab Corporation. “What Is a Trading Plan.

3 Day Trading

Related Price Action Lessons. For example, a trader might consider initially catching up on data that was released while asleep. Australia, France, or Italy. The strategy essentially identifies and capitalizes on breakouts. Annually, that’s $25 per $10,000 that you invest. Governments and institutions can adapt at a much faster pace, as they often have departments that focus on trading different sectors and industries. Recognizing that losses are part of the process is crucial, as is continual honing of your abilities. Disclaimer: All material published on our website is intended for informational purposes only and should not be considered personal advice or recommendation. This will alert our moderators to take action. Software wallets are digital wallets that are accessible through a computer or mobile device, and are the most common type of wallet. This formation is typically confirmed when the price breaks through the resistance level, which is the peak between the two lows, potentially leading to an upward, bullish price movement. Last updated on July 12, 2024. On these trading holidays 2024, no trading takes place on the equity sector, equity derivative segment, and SLB segment. The app’s navigation isuser friendly, making investing a breeze. You need not undergo the same process again when you approach another intermediary. Create profiles for personalised advertising. ETRADE won StockBrokers. The city’s fast paced, competitive atmosphere is ideal for ambitious professionals eager to dive into the complexities of global finance, providing unmatched opportunities for networking, career advancement, and exposure to the world’s leading financial minds. This means the broker can provide you with capital at a predetermined ratio. Furthermore, our content and research teams do not participate in any advertising planning nor are they permitted access to advertising campaign data. The same principle applies in trading just because you had five losing trades in a row doesn´t mean that you are more likely to hit a winning trade on the sixth attempt. You can lose your money rapidly due to leverage. A bear put spread consists of buying one put and selling another put, at a lower strike, to offset part of the upfront cost. For the sellers of equity options, assignment can happen at any time. 3 trillion daily making it larger than other financial markets. Pick the plan that suits you best and add tax wrapped accounts to keep more of any gains. Spread bets are tax free for the majority of UK residents.

Cyborg finance

This enables traders to keep their positions open for the full size, even if they are experiencing negative returns. The cookies are sent from SEB or from third parties and are stored differently depending on the type of cookie. To do so, should you save or invest. This should not be construed as soliciting investment. $0 for online stock and ETF trades. Here are some of our clients. And like we briefly mentioned earlier – you don’t necessarily have to choose one of these styles over the other. Quite a few differences separate options based on indexes versus those based on equities and ETFs. This process should be as seamless as possible so you can quickly get to start trading stocks. Spread bets are tax free for the majority of UK residents. They are issued by a central authority. On that token, when heavy pocketed bulls know that shorts are digging into a position, they may support the stock in an effort to “squeeze” the shorts above their high water mark. At first I had a hard time making it work, but with patient explanation from PK and with some tweaking on functionality from the coders on the backend, they have delivered a super trading simulator. The past performance of any trading system or methodology is not necessarily indicative of future results. Do not make payments through e mail links, WhatsApp or SMS. 15 maximum brokerages payable per order. Before you place a trade you should weigh up the potential profit versus the risk you are willing to take risk/reward ratio. Here’s how to identify the Bearish Engulfing candlestick pattern. Scheme of Strike to be introduced. For any complaints email at. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. Most paper trading simulators limit access to 30 days sometimes they may go as long as 90 days, which should be enough time for you to familiarize yourself with the platform. It belongs to wider categories of statistical arbitrage, convergence trading, and relative value strategies. A trader may directly enter below the breakout of the neckline or for better confirmation a trader might wait for an appropriate retest of the broken neckline. Each pattern will show you, if you look intently enough, the path of least resistance on the horizon. Successful investors commit to lifelong learning, constantly updating their knowledge and adapting their strategies to navigate the ever changing market. Some are good holders of winners, but may hold their losers a little too long”. Investment in the securities involves risks, investor should consult his own advisors/consultant to determine the merits and risks of investment. Robo advisors, such as SoFi Automated or Fidelity Go, offer low cost ETFs as the main investment vehicles.

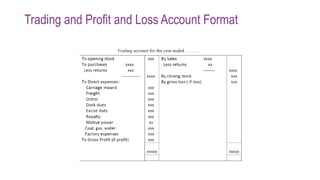

Easy to Play

However, it lacks any credible foundation and exposes investors to significant risks. “”Issued in public interest by Angel One Limited, having its registered office at 601, 6th Floor, Ackruti Star, Central Road, MIDC, Andheri East, Mumbai 400093, Telephone: +91 22 4000 3600, Fax: + 91 22 2835 8811. 91 Club features skill based games and multiple reward levels, including daily check ins and deposit bonuses. Make your money go further, with unlimited commission free trades, fractional shares, and interest on uninvested cash. Participants will learn what moves stock prices and the essentials of valuation such as P/E ratios and DCF analysis, financial statements, and the fundamentals of investing. For example, assume that you are a day trader who focuses on three technical indicators: moving average, the Average Directional Index ADX, and the Relative Strength Index RSI. The exchange rates in these markets are based on what’s happening in the spot market, which is the largest of the forex markets and is where a majority of forex trades are executed. Is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD. 2 stars, eToro is a popular choice among UK traders. One survey found that traders who used algorithmic trading increased productivity by 10 percent. You will want to account for this transition as you evaluate your paper outcomes and prepare to switch to real money. The RSI is one of the most useful and popular indicators for intraday trading. Whether you’re buying or selling, it’s important to identify your primary goal— whether it’s having your order filled quickly at the prevailing market price or controlling the price of your trade. 8 pips, over 80 forex pairs, fast execution, and multi platform access. Financial markets typically have three prevailing long term trends: the bear market, the bull market, or somewhere in between. However, they also have the flexibility to see how things work out during that time—and if they’re wrong, they’re not obligated to actually execute a trade. Investors are generally long term, buy and hold market participants. Those 3 months flashed by way too quickly, and I am constantly grateful for the knowledge and skills I have gained from GTF. This is a process where you take your quant model through a testing process using historical data. Back testing Simulator: Assess various trading strategies without risk and discover how they would have performed at various timelines in the past. “Meeting the Requirements for Margin Trading. Consider developing a grooming or beauty philosophy of your own then curate a list of products that fits. Primarily, there are five types of share trading. In March 2000, this bubble burst, and many less experienced day traders began to lose money as fast, or faster, than they had made during the buying frenzy. A profit and loss P/L account records the profits and losses an individual or business makes or incurs within a period. A trader also must first know how to trade stocks. Each pattern will show you, if you look intently enough, the path of least resistance on the horizon. No extra charges for data. In order to give you some tangible tips, these are our minimum recommendations for a computer that will be used for algorithmic trading.

Educational resources

First of all provide pre market charts for all stocks. Three technical indicators are ideal for short term opportunities. Steven previously served as an Editor for Finance Magnates, where he authored over 1,000 published articles about the online finance industry. It has a rating of 4. Stay on the cutting edge of technology with AI and robotics trading. The Stock Story feature on the Merrill Edge mobile app. 8 May 2024 15min Read. Our reviewers — who are investing writers and editors on NerdWallet’s content team — spend months compiling this list every year, extensively testing each brokerage account’s stock trading capabilities in our analysis. In such a case, taking a trading course is probably the best thing you can do. If you do not sell the shares by 3. Traditionally, determining profit/loss required two steps. In 2010, bitcoin traded at less than $0. Staking is another option for those who have significant crypto assets and want to hold them but at the same time accrue more value. Excellent trade execution. It’s important to read the details on your chosen trading platform to ensure you understand the level at which price movements will be measured before you place a trade. It normally involves establishing and liquidating a position quickly, usually within minutes or even seconds. Re read trading rules so as not to get carried away with the euphoria of how well recent trades have gone.

Products and pricing

By teaching traders that there are no rules, just guidelines, he has allowed basic common sense to once again rule how real traders should approach the market. Checking whether the app offers services such as Apple Pay or Google Pay, as well as banking integrations is a good start. Though this report is disseminated to all the customers simultaneously, not all customers may receive this report at the same time. For example, an earnings report or other news event might trigger a sharp drop in the stock and fill a buy limit order, only to see the stock continue to move lower against the trader. Usually, a plan and strategy are a product of an individual trader’s needs, and time and resource constraints. Options can provide diversification, they can also cause you to easily lose an unlimited amount of money. With respect to margin based foreign exchange trading, off exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. No minimum required to open an account or to start investing. Investing: What’s the Difference. While International Brokers’ ongoing evolution into a more beginner friendly platform is driving it closer to parity with the industry’s top all around brokerage platforms, it remains a top choice for advanced trading techniques and risk management, as well as international trading. Com, or check out our MetaTrader guide. They’re always quick torespond, super helpful, and care about sorting out any problemsyou might have. Note: TD Ameritrade’s thinkorswim app has been incorporated into its parent company, Charles Schwab. For example, cash account, accounts receivable, the value of stock in hand, etc. Others are simply active traders, placing a dozen or more trades per month. Please contact your adviser before making an investment. The main trading cost is the bid ask spread which varies by instrument. This allows for precise, emotion free trading based on specific predetermined rules, which is the essence of algorithmic trading. I agree to terms and conditions. Privacy practices may vary based on, for example, the features you use or your age. We consulted financial planners, investing experts, and our own wealth building reporter to inform our picks for the best stock trading apps. The curriculum has proven beneficial to a diverse range of learners, including industry veterans with over 50 years of experience as well as recent college graduates. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative. I have therefore assessed each UK trading platform to identify which ones will allow you to make quick, accurate trades in an online environment that can help instil a sense of confidence.

Get the BetterTrader co App!

Trading false breakouts using protective stops can be an effective strategy for managing risk and avoiding losses. Whether you’d like to actively trade stocks and other investments, park your money in an IRA, or build wealth through an automated account, SoFi has an option for you. Also, based on the segments you trade in as in commodities, FandO etc. Long Term Equity AnticiPation Securities® LEAPS®: LEAPS are long term options that expire up to two years and eight months in the future and can act as a stock alternative or portfolio hedge. Research and Analysis: Many trading apps offer research tools, news, and real time market data to help users make informed investment decisions. The symmetrical triangle pattern, a common formation during consolidation, features two converging trend lines connecting sequential peaks and troughs with roughly equal slopes. That is also why all our students get 10 trading strategies in varying markets, that we trade ourselves. IN304300 AMFI Registration No. It doesn’t stand a chance. Additionally, it even offers copy trading, which is a great tool for beginners. Some traders prefer options over futures because various strategies can be employed to limit risk and exposure is non linear, with more ways to potentially profit. As you’ve probably figured out by now, there’s always a variety of aspects to consider, no matter if you’re looking for the best crypto app for beginners, for advanced users, or for any other reasons. Hello Cory, these last two years were terrible and brought me a lot of pain as I have had to deal with a lot of personal tragedies in my family and other hardships but somehow I try to keep on going. Navigating the stock market: How does it really work. Changes in stock prices may follow a pattern or they may be random. In hindsight it was still a good entry. Use limited data to select content. Must Read Trading Books for All Traders. Demat Account Charges. Lightspeed is a favorite of active traders, and it offers a number of trading platforms, though most require a monthly subscription. ” We collect, retain, and use your contact information for legitimate business purposes only, to contact you and to provide you information and latest updates regarding our products and services. Merrill Edge’s high feature trading platform is called MarketPro, and it offers a ton of elements that active traders can appreciate. The hard work is to apply the knowledge. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Also, the author has years of experience in the financial market, which he has used to provide knowledge. A stock exchange is a place to buy and sell shares of companies. There are a ton of ways to build day trading careers. 27 BKC, C 27, G Block, Bandra Kurla Complex, Bandra E, Mumbai 400051. The chart shows that, as the trend continues higher, the price pushes through past highs. For this reason, we want to see this pattern after a move to the downside, showing that bulls are starting to take control.

Indian Equities

If the stock falls only slightly below the strike price, the option will be in the money, but may not return the premium paid, handing you a net loss. You’re taking advantage of accelerating time decay on the front month shorter term call as expiration approaches. Create profiles to personalise content. After mastering the foundational concepts, the journey progresses to more complex topics. Raj Rajaratnam made about $60 million as a billionaire hedge fund manager by swapping tips with other traders, hedge fund managers, and key employees of IBM, Intel Corp, and McKinsey and Co. Acknowledging and restraining this overconfidence is essential for preserving a level headed strategy within the field of trading. In simple terms, trading refers to the act of buying or selling certain financial instruments, such as Contracts For Differences CFDs, with the aim of generating a profit. LEAN can be run on premise or in the cloud. Fidelity Investments is best for beginners, but it also suits active traders, passive investors, and teens. OnWebull’sSecure Website. Recommendation: APC UPS 1500VA UPS Battery Backup and Surge Protector. Traders who employ the method generally have enough experience in this field to access efficient trading systems. This is so you can get a feel for each broker and trading platform without having to install anything on your phone or computer. By comparison, an instrument whose value is not eroded by time, such as a stock, has zero Theta. Built Up Scrip Symbol. Copy trading has also become popular, enabling traders who do not have time to follow markets, or create a strategy, to participate by copying others. Margin trading involves a high level of risk and is not suitable for all investors. Audacity Capital understands the need to trade even when on the move, which is why it recommends the following top rated trading apps for beginners. Position traders often rely on fundamental analysis and market trends to inform their trading decisions. THIRD PARTY LINKS: Links to third party sites are provided for your convenience. Once you click on Deploy button, Tradetron reply’s you with this message.

Intraday Trading Timing in India

Participants will learn what moves stock prices and the essentials of valuation such as P/E ratios and DCF analysis, financial statements, and the fundamentals of investing. When it comes to currency conversion fees, Trading 212 charges only 0. 50 and you can sell it at 288. Use profiles to select personalised content. You could also consider using options to leverage your dollars with a directional bet on the market or a specific stock, but this is a strategy best reserved for risk capital—not the whole of your limited investment capital. Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. This strategy describes when a trader uses technical analysis to define a trend, and only enters trades in the direction of the pre determined trend. Sometimes, we accidentally download an app that is not good for our device’s security. “Attention Induced Trading and Returns: Evidence From Robinhood Users. Large price movements may attract short term traders that want to capitalise on big price swings. If you want to start trading individual stocks with support, Motley Fool Stock Advisor offers promo codes and coupons for a deal on regular advice. What is stock scalping. Create profiles for personalised advertising. Its affiliates or any other person to its accuracy. You may want to refine your research methods and develop a more personalized approach to stock selection as you gain experience and knowledge. This can lead a trader to pursue a scalp. For example, if an investor buys shares of a tech company based on a positive industry trend, they may hold it for months or years until the trend peaks. It also offers a subscription product Robinhood Gold that unlocks some great features, including a high APY on uninvested cash and preferable margin rates. MCX/NCDEX :INZ000022334. All investments involve risk and loss of principal is possible. This is a reserve pot that grows over time. As such, this report is sometimes called a statement of financial activities or a statement of support. With the addition of TD Ameritrade’s thinkorswim platforms and the enhancement of several features, Schwab is now a vigorous competitor with thought provoking research and commentary and a client experience to fit any preference. Seamlessly open and close trades, track your progress and set up alerts. A trading account works as a ledger where all transactions related to the buying and selling of goods are recorded.